If you are insured with us, you pay an insurance premium. You may wonder what happens with all these premiums.

We use the premiums we receive to pay the claims from our insured persons. But we also use them to pay company costs such as our employees’ wages. Of course, we also take into account the money that will be needed to honour future claims. We set this aside.

In addition, we also have our own capital. This is a general reserve that ensures that OOM is able to handle any future setbacks. Having sufficient own capital means we are a financially stable insurer.

As an insurance company, we manage considerable assets. We invest these assets to create a return on investment.

As a client, you must be able to trust that we handle these assets with care. Like our clients, we too believe it is important that our premiums are invested sustainably. I.e., in funds that bear in mind the environment, human rights, working conditions and good corporate governance. Our investment policy is based on the OESO and United Nations guidelines, and is in accordance with the ICSR covenant*) of the Dutch Association of Insurers.

Sustainable investment

Sustainable and green investment is a broad concept. Another definition is: ESG investment. This stands for: Environmental, Social and Governance. In other words, when investing, you take into account environmental aspects, social aspects and the way a company is run.

More and more investors not only focus on the profit a company makes, but also on other aspects such as:

- The CO2 emissions of companies

- Employee working conditions

- If the company is avoiding taxes

At OOM, we are convinced that investments that take into account environmental, social and governance aspects provide better returns in the long term than those that do not. We also want our investments to contribute to a more sustainable world. This is the social responsibility we, as an insurer, have.

Green investments via an asset manager

We do not make investments ourselves. An external specialist asset manager helps us with this. We expect our asset managers to consider sustainability when making investment decisions. For example, by taking a company’s sustainability score into account.

Our asset manager also has to report to us about how the investment portfolio scores in terms of sustainability. Our sustainable investment policy describes exactly what we ask of our asset manager.

Voting and involvement policy regarding sustainability

You become a shareholder when you own shares of a company. As a shareholder, you are a co-owner of the company and can influence its policies and operations. For example, by voting during shareholder meetings. Or by talking to the company in which you are investing. As a shareholder, you can influence the sustainability transition of a company. At OOM, we have outsourced the voting and involvement policy in companies to our asset manager.

We want our asset manager to focus on the themes that are important to us. The asset manager must be able to show that they are working on the priorities of OOM Verzekeringen. If necessary, we ask our asset manager to focus more on these.

Sustainable investment priorities

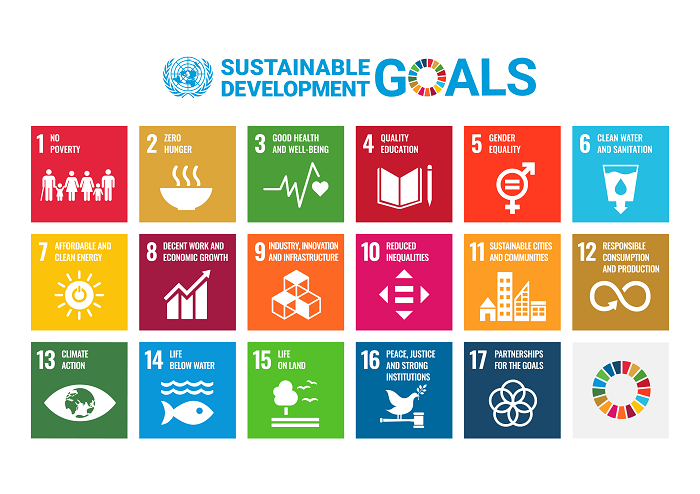

The United Nations has set 17 goals to improve the world by 2030. These are the 17 goals:

In our sustainable investment policy, we have chosen to prioritise two of these goals:

- Development Goal 3: Good health and well-being

- Development Goal 8: Decent work and economic growth

In consultation with our asset manager, we look at how we can contribute to realising these goals. We prefer to invest in companies and investment funds that have one of these two goals as their sustainability objective.

Sustainable investment policy

We may exclude certain investments altogether. Primarily, we want our asset manager to focus on realising positive change. For example, by entering into a dialogue with companies in the investment portfolio, to encourage them to make their business operations more sustainable. If the positive changes turn out not to be feasible, we will exclude the company.

We support the United Nations Global Compact Principles. The Global Compact is a worldwide initiative of the United Nations with ten principles in the areas of human rights, labour, the environment and corruption. Our asset manager must use these ten principles as a guideline when making investment decisions.